Taxpayers submitting their tax declarations on paper will now also be able to make a 2% designation of their income tax. While this option had previously been available, it was removed by amendments to the Tax Code in 2023 (entering into force on the 1st of January 2024). These amendments limited the percentage designation mechanism to those taxpayers who submitted their tax declarations electronically. Since the majority of tax declarations in 2023 were submitted on paper, civil society was concerned this change would lead to a decrease in the number of designations. New amendments to the Tax Code adopted by the Parliament on the 21st of March 2024, bring this option back.

In 2023, only about 20,000 persons submitted income declarations electronically, and of these, only about 9,000 chose to direct 2% to a CSO. At the same time, 29,000 designations were made on paper. In the beginning of 2024, CONTACT Center organised meetings with relevant authorities to convince them about the importance of making the 2% designation possible also for taxpayers who submit their declarations on paper. As a result, on 28 February, 2024, deputy Dorian Istrati registered an amendment of Article 187 paragraph (21) of Tax Code 1163/1997, providing an alternative to make the designation either with the income tax report on paper or using automated electronic reporting methods. On March 21, 2024, the Parliament passed the amendments to the Tax Code in the second reading.

The deadline for submitting annual income tax reports is April 30. This means that persons who have not yet submitted their annual tax declaration have one more month to make the percentage designation on paper. Unfortunately, the changes have not been largely publicised, meaning the general public may not be aware of this year's change in percentage designation conditions.

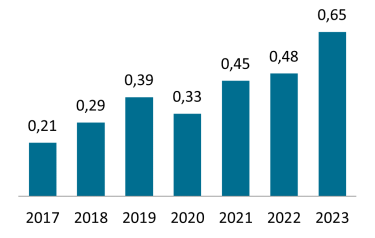

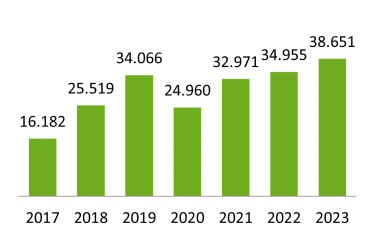

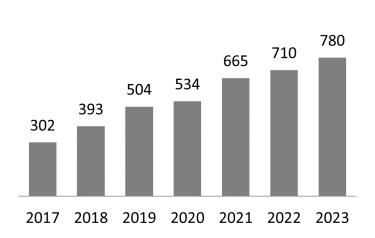

This year's figures will show whether the variations in the regulation of the procedure will have any impact on the receipts. Until now, the dynamic of the indicators was positive, and the last year accounted for the highest indicators, which were on a positive trend since the introduction of the mechanism in 2017 (except the gap during the pandemic period). Thus in 2023, 780 CSOs received cumulatively about 0.65 million Euros from over 38 thousand taxpayers.

Designated amounts (million Euro)

Number of valid contributions

CSOs recipients of designations

Source of data: State tax service of Moldova