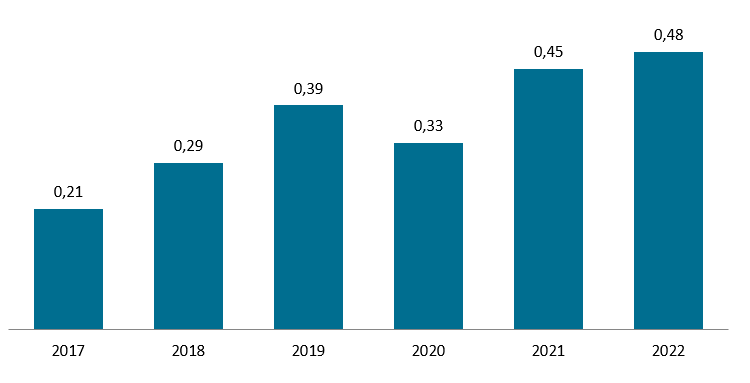

According to the figures presented by the State Tax Service of the Republic of Moldova, in 2022 the total income of CSOs from the 2% designation mechanism amounted to over 0,48 million Euros. The allocated amount somewhat increased compared to the previous year and is now at its highest annual value - more than double since the mechanism was introduced in 2017.

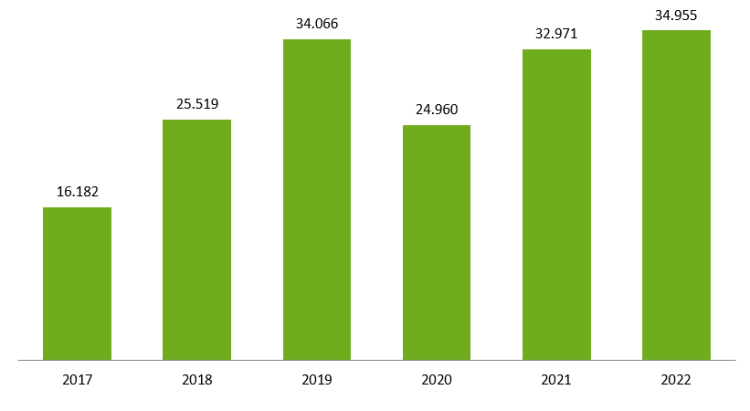

The number of validated contributions has also increased up to almost 35.000. The number could have been even higher, but the State Tax Service invalidated over 2.000 contributions – most of them because the contributor had income tax debts. The 37.000 persons who used the mechanism represent 2,5% of the total number of taxpayers (natural persons) from the Republic of Moldova. This rate shows that the pool of potential contributors is underutilised and that there is room for improvement.

Designated amounts (million Euro):

Number of valid contributions:

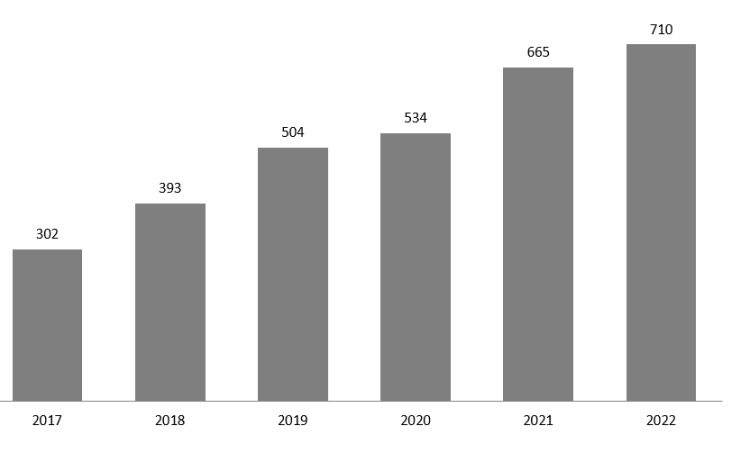

The number of CSOs that received designations has also increased to 710 CSOs – 45 more than in 2021. It is the highest number of CSOs recipients since the mechanism was launched six years ago. However, this is the lowest annual percentage increase (+6,8%) except for the first pandemic year (+6% in 2020).

CSO recipients of designations:

The largest amount received by a CSO in 2022 was of approximately 27.000 Euros, which represents 5,5% of the total validated amount. 83% of CSOs received less than 1.000 Euros. Most recipient CSOs are located in Chisinau (60%) and received 67% of the total allocated amount, while only 25,6% of contributors are located in Chisinau.

The numbers show that the mechanism overcame the pandemic drop in 2020 and is back on the growth trend, but it is far from fulfilling its maximum potential.